QuickBooks

Integrate FL3XX with QuickBooks to automatically sync customers, products, and invoices. Manage your accounting workflows directly from FL3XX — including automated invoice creation and line-item mapping.

About

QuickBooks by Intuit is one of the most widely used accounting systems worldwide.

It simplifies financial management by enabling small and large businesses to handle invoicing, expense tracking, and reporting in a single platform.

The FL3XX – QuickBooks integration allows operators to automatically synchronize accounting data such as customers, products, and invoices between both systems, ensuring accurate and up-to-date financial information without manual re-entry.

The FL3XX – QuickBooks integration works exclusively with QuickBooks Online.

QuickBooks Desktop or other versions are not supported, as the integration relies on the QuickBooks Online API for data exchange and authentication

Key Features

FL3XX supports the following key features with QuickBooks Online:

-

🔗 Secure OAuth2 connection between FL3XX and QuickBooks

-

👥 Customer/Accounts synchronization between systems

-

🧾 Automatic invoice creation in QuickBooks when invoices are sent or silent-sent in FL3XX

-

🧩 Product/Service mapping between FL3XX line items and QuickBooks items

-

⚙️ Custom invocing settings to simplify or aggregate line items

How It Works

1. Connect FL3XX to QuickBooks

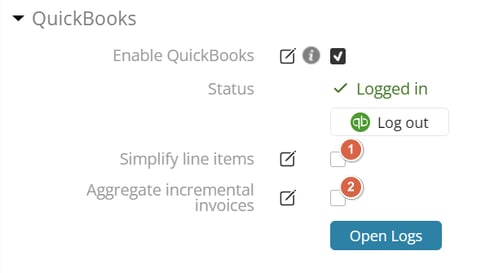

Once the integration is enabled under Settings → Integrations → QuickBooks, click Enable QuickBooks[1] and then Login in to QuickBooks [2]

The system will redirect you to the QuickBooks login page where you can authorize FL3XX to access your company data via a secure OAuth2 connection.

🔐 After successful authorization, the integration is automatically established and you’ll be redirected back to the FL3XX QuickBooks settings page [3]

2. Configure QuickBooks Integration

After the connection is established, additional configuration options are available under Integration → QuickBooks for your usage

Here you can:

-

Enable or disable specific features

-

Map FL3XX accounts to QuickBooks customers

-

Link FL3XX line items or accounting codes to QuickBooks Product/Service items

Available settings:

| Setting | Description | Type | Default |

|---|---|---|---|

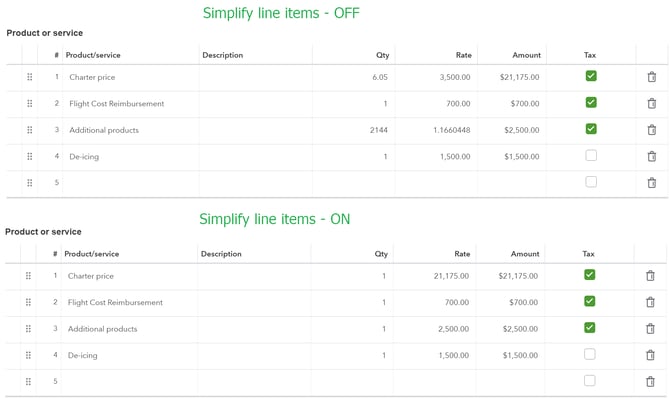

| Simplify line items [1] | When enabled, all invoice lines are exported with Qty = 1 and Rate = Total Amount. | Checkbox | OFF |

| Aggregate incremental invoices [2] | When enabled, incremental invoices (all invoices after first issued) are exported as a single aggregated line showing total delta in booking price change | Checkbox | OFF |

Simplified line items setting:

Aggregate incremental invoices setting:

💡 Note on aggregate setting: Because all line items are combined into one for Aggregate incremental invoices setting, the system cannot assign multiple QuickBooks Products/Services at the same time. Therefore, the entire aggregated invoice line item will be saved under the default “Services” name in QuickBooks.

🕒 Payment Terms / Due Date

When you need invoice payment terms that differ from the customer’s defaults in QuickBooks, set Default Invoice Due Days which is available in Settings. FL3XX will use this value to calculate the invoice due date and send it to QuickBooks (e.g., 0 = Due on Receipt, 7 = Net 7, 14 = Net 14, 30 = Net 30).

Location: Settings → Configuration → Common → Default Invoice Due Days

If left empty: QuickBooks will apply the customer’s default payment terms (as configured on that customer in QuickBooks).

3. Link FL3XX Accounts to QuickBooks Customers

Once integration is active, FL3XX can automatically retrieves the list of customers from QuickBooks via API.

💡 Note on automatic customer linking: FL3XX automatically tries to find the matching QuickBooks Customer by comparing the Display Name in QuickBooks with the Account you’re invoicing in FL3XX. If a match is found, the account is auto-linked to that QuickBooks customer during invoice creation.

You can always manually link accounts directly in the Account page in FL3XX by selecting corresponding QuickBooks customer from DDL [1]

4. Link FL3XX Line Items to QuickBooks Products/Services

In the Settings → Accounting Codes page, you can link FL3XX line items to corresponding Product/Service entries from QuickBooks.

-

Each FL3XX line item is displayed under Description column

-

Any QuickBooks corresponding product/service is available for selection in DDL under Product/Services column [1]

5. Automatic Invoice Creation

FL3XX automatically creates an invoice in QuickBooks whenever an invoice is sent or silent-sent from FL3XX using dedicated button [1][2]. This ensures that each finalized invoice in FL3XX has a corresponding record in QuickBooks for accounting purposes.

If users prefer to manage synchronization manually, there is also a dedicated “Send to QuickBooks” button available in the Invoices panel [3]

This option allows you to:

-

Send invoices manually to QuickBooks at any time

-

Re-send an invoice again if needed

Each invoice in FL3XX displays a QuickBooks Sync Status, showing whether it has been successfully sent to QuickBooks or not yet sent.

In case of a synchronization error (e.g., missing account/products mapping), the system will display an error message next to the invoice record, allowing users to quickly identify and resolve the issue before retrying.

💡 Note on resending invoice: When you resend an invoice, FL3XX creates a new invoice in QuickBooks — it does not update an existing one.

💡 Note on invoice look: Each invoice created in QuickBooks has a corresponding record in FL3XX, however the visual representation (layout, totals, line-item order, etc.) may differ depending on each system’s display configuration.

6. Rounding, Tax Calculation and Handling

QuickBooks applies its own internal rounding logic when calculating invoice totals and taxes. If your organization uses rounding settings in FL3XX that differ from those configured in QuickBooks, you may observe minor discrepancies between the amounts displayed in both systems.

To ensure consistent results, it is recommended to align rounding preferences across FL3XX and QuickBooks wherever possible.

Aviation tax structures differ significantly from standard commercial taxes. Unlike typical flat-percentage taxes applied to an entire invoice (as in most QuickBooks configurations), aviation taxes such as Federal Excise Tax (FET) or certain passenger-related charges often depend on the type of flight segment or portion of the route being taxable.

For example:

-

FET may apply only to U.S. domestic portions of a trip, excluding international waters.

-

Passenger or airport taxes can differ per leg, depending on the departure/arrival country or charter type.

Because QuickBooks does not natively support such conditional, segment-based tax logic, FL3XX handles these calculations independently before sending data to QuickBooks.

When invoices are created via the FL3XX → QuickBooks integration:

-

💡 FL3XX provides the exact calculated tax value (e.g., FET, VAT, PaxTax or other jurisdictional taxes) to QuickBooks.

-

QuickBooks then records this as part of the invoice without applying its own internal tax engine.

-

This ensures that aviation-specific tax rules are correctly respected and consistently reported.

📝Summary

Activation

There is no need to contact FL3XX Support to activate the QuickBooks integration.

It is a self-configured integration — all you need is an active QuickBooks Online account.

For the best experience:

-

Start by enabling the integration under Settings → Integrations → QuickBooks.

-

Configure the additional settings according to your accounting preferences.

-

Ensure that your FL3XX line items are correctly linked to corresponding QuickBooks Products/Services.

-

If you maintain different customer names between systems, make sure to link FL3XX accounts with QuickBooks customers to ensure invoices are synchronized correctly.

Troubleshooting

If you experience issues with authorization or integration itself please contact support@fl3xx.com for assistance with connection re-authorization