Product Update 22-24 September 2025 | v9.1

Index

1. Canadian Sales Tax Calculation

What's new:

FL3XX automatically calculates the Canadian Sales Tax based on the departure airport of a flight:

| 5% GST* |

|

| 13% HST** | Ontario (ON) |

| 14% HST** | Nova Scotia (NS) |

| 15% HST** |

|

| 14.975% QST*** | Quebec (QC) |

*GST = Goods and Services Tax

**HST = Harmonized Sales Tax

***QST = Quebec Sales Tax

Additional rules apply if:

- There are multiple legs of the same trip on one calendar day.

- The flight is destined to/returning from the US/Alaska.

- The flight is private, in which case no Sales Tax is calculated by FL3XX.

This update is available to all users with a FL3XX subscription. For more information visit the Knowledge Base.

![]()

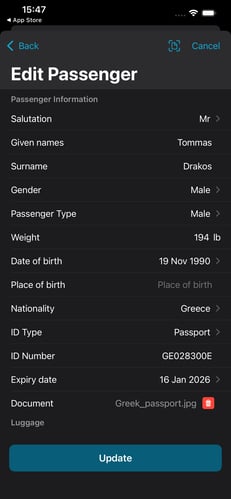

2. Mobile: Crew & Dispatch App Updates

What's new:

Crew App Update

We are introducing FL3XX Chat for the iOS and the Android Crew App, enabling per-booking messaging with a familiar SMS-style interface. FL3XX Chat is accessible via the Flight Details menu, with unread message indicators and real-time updates.

Dispatch App Update

For both, the iOS and the Android Dispatch App, we are introducing FL3XX Chat, which enables per-booking messaging with a familiar SMS-style interface. FL3XX Chat is accessible via the Flight Details menu, with unread message indicators and real-time updates.

Furthermore, the upgraded passenger management allows users to add, edit, or remove passengers for flights, with seamless integration to the Persons database for quick searches.

Moreover, FL3XX is introducing passport scanning for rapid, accurate passenger data entry, with options to update existing records or create new ones, while preserving unchanged fields where possible.

View the updates for the complete FL3XX Mobile suite in the Knowledge Base for more information.

![]()

3. FL3XX at NBAA-BACE 2025